The Bank-less Documentary Collection Model: Speculation or Inevitable Shift?

This is not a prediction.

It’s a thought experiment — a way to tie together several real developments already happening in global trade:

- Digital originals (eBL, e-Invoice, digital COOs)

- LEI / vLEI identity rails

- Electronic Payment Undertakings (ePU)

- MLETR-aligned digital trade laws

- Platform-driven document control

And imagine what happens if we direct all these forces specifically toward Documentary Collection.

What follows is a scenario that is not live today — but absolutely within the realm of “this could start emerging.”

State of the Market: Why This Thought Experiment Isn’t Far-Fetched

Before jumping into the imaginary 2032 model, here’s what’s already happening:

1. Digital Originals Are Becoming Mainstream

Platforms like WaveBL, CargoX, essDOCS, TradeGo, Bolero, etc., already support:

- Electronic Bills of Lading (eBL)

- Transfer of title

- Secure digital document exchange

2. Identity Rails Are Getting Stronger (vLEI)

GLEIF’s vLEI initiative enables:

- Cryptographically verifiable organizational identity

- Role-based digital credentials

- Automated trust validation for trade platforms

3. Digital Negotiable Instruments & ePU Models

ITFA’s DNI framework and electronic Payment Undertaking (ePU) bring:

- Digitally enforceable promises to pay

- Legal equivalence to traditional negotiable instruments

- Growing adoption among banks & fintechs

4. MLETR & Digital Trade Laws Are Changing the Game

Countries adopting MLETR-style laws grant:

- Full legal recognition to digital trade documents

- Straight-through digital document workflows

- Removal of paper-based constraints

All the ingredients exist. No one has stitched them together specifically for Documentary Collection, but the building blocks are real.

This article imagines what that stitching could look like.

A Possible 2032 Scenario

Close your eyes and imagine this world.

It’s 2032.

- Global trade runs entirely on tamper-proof digital originals

- eBL, e-Invoices, Packing Lists, digital COOs are all verifiable electronic documents

- No paper, no couriers, no physical document routing

- Platforms complete settlement instructions — not bank counters

- Documentary Collection has no physical movement layer whatsoever

In that world, the “execution rail” of DC — the part where documents move between banks —is replaced by digital originals, identity, and automated control transfer.

Banks still finance trade.Banks still manage risk. Banks still govern instruments.

But the movement + acceptance rails? System logic.

Re-thinking the Flow for a Bank- and Courier-less Execution World

Here’s how this digital model might work in practice.

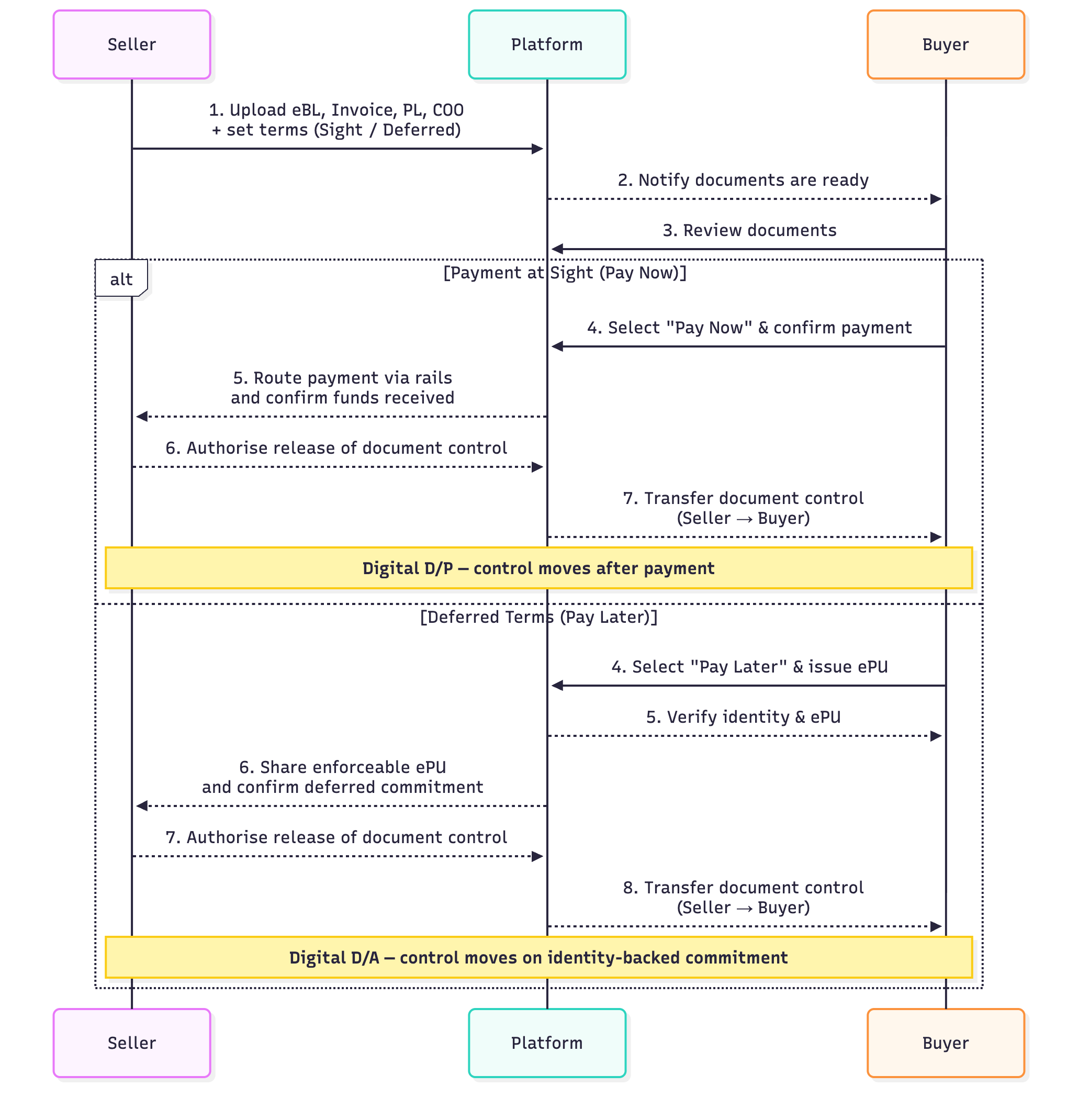

The seller still creates the collection digitally, the buyer still reviews documents, and the platform orchestrates everything.

But instead of physical documents travelling between banks, control moves based on payment or identity-backed commitment.

Below is a unified sequence showing both — Payment at Sight (digital D/P) and Deferred Terms (digital D/A) — in one view:

A quick aside:Smart contracts could automate many of these steps — conditional releases, identity checks, payment triggers, control transfers.

Ironically, several well-funded blockchain trade platforms from the last decade (we.trade, Contour, Marco Polo, etc.) died slow, quiet deaths.But who knows — maybe by 2032 they’ll rise from the ashes and say “We were early, not wrong.” 😄

Whatever the underlying architecture, the point remains:The movement rail of Documentary Collection doesn’t have to be physical or bank-mediated if digital originals + identity + settlement logic converge.

Identity Becomes the New Acceptance Instrument

The shift looks like this:

| Traditional Rail | Identity-Based Rail |

|---|---|

| Buyer accepts via their bank | Buyer commits via LEI-verified ePU |

| Seller receives accepted instrument from bank | Seller receives digital, identity-verified undertaking |

| Document release tied to physical movement | Document control tied to identity + settlement logic |

Execution becomes:

Identity → Control → Settlement instead of Bank → Courier → Paper Release.

Shipment Matching: Rethinking an Old Risk

Banks have always struggled to guarantee that:

Documents routed through them match the actual shipment on a vessel.

The mismatch risk never went away because execution was:

- Sequential

- Manual

- Disconnected from real-world movement

A digital world doesn’t eliminate this risk —but it does allow smarter, data-driven mitigation:

Smart Risk Controls

- Real-time vessel identity validation

- AIS-based live movement tracking

- Correlation between document timestamps & voyage events

- Early detection of delays, diversions, or mismatches

For the first time, we can link:

Document identity → Shipment identity → Physical movementin real time.

Same risk. Better tools. Better orchestration.

So… Could Execution Move Away From Banks?

Imagine a future where:

- Banks remain the financing and risk layer

- But execution (movement + acceptance + control transfer)is run by digital originals, identity standards, and system logic

Is this guaranteed to happen? No.

Is the industry already moving in this direction in pieces? Absolutely.

Is it worth thinking about how DC evolves once documents no longer move? Definitely.

Venzo Perspective

Digital originals, identity rails, and programmable settlement logic are not theoretical toys anymore — they’re quietly becoming the building blocks of global trade. Documentary Collection may not disappear, but its execution could shift away from couriers and counters to a world where identity, control, and automation do the heavy lifting.

If the rails change, every participant in the ecosystem — banks, platforms, carriers, corporates — will need to rethink where they add value and how they remain relevant.

The next decade won’t be about replacing banks.

It will be about replacing movement.